MARKET REPORTS

Metro Denver Real Estate Market Report - September 2019

SEPTEMBER 2019 - DENVER METRO REAL ESTATE MARKET

While Denver-area homebuyers have a number of market conditions in their favor, home sales were down overall last month. In August, new listings, homes under contract, and days on market were up for Denver-area’s entire residential market. The number of homes sold, average and median sold prices, and sales volume were down, as were interest rates.

While Denver-area homebuyers have a number of market conditions in their favor, home sales were down overall last month.

#DMAR Market Trends

Data Source: REColorado

In August, new listings, homes under contract, and days on market were up for Denver-area’s entire residential market. The number of homes sold, average and median sold prices, and sales volume were down, as were interest rates.

“In 2019, homebuyers and sellers are not having the same experience their neighbors did last year,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “In the first half of 2018, home sellers were taking offers over the weekend and selecting the best one in the stack on Monday. This year, sellers are making price adjustments as they try and find the right price point to entice buyers to make an offer.”

Furthermore, median days on market has jumped up 27.27 percent from July to August and up a significant 57.14 percent year to date. While the percentage is significant, it reflects an increase of seven days to 11 year over year.

According to Schafer, buyers have appreciated this slightly slower paced real estate market. They have an option to compare a number of homes on the same day, instead of one home at a time as they trickle onto the market throughout the month. Homebuyers have even been able to do some negotiating as the close-to-list-price ratio dropped to 99.36 percent year to date compared to above 100 percent at this point in the past few years. The lower interest rates also improved their buying power allowing some to move up in price.

While homebuyers have a number of market conditions in their favor, the number of homes sold in August was down 10.91 percent month over month and 0.72 percent year to date compared to last year.

Schafer comments, “Sellers should still be skipping happily on the real estate playground. Even though they aren’t selling their homes as quickly, they are still getting more money than they would have last year.” Average and median sold prices dropped a bit month over month but were up 2.22 percent and 1.45 percent respectively year to date compared to 2018.

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999). In August 2019, 222 homes sold and closed for $1 million or greater – down 11.20 percent from July and up 5.71 percent year over year. The closed dollar volume in the luxury segment year to date was $2.578 billion, up 28.80 percent from last year.

The highest-priced single-family home that sold in August was $7,200,000 representing five bedrooms, six bathrooms and 7,295 above ground square feet in Niwot, just outside of Boulder. The highest-priced condo sale was $5,525,000 representing three bedrooms, four bathrooms and 5,092 above ground square feet in Denver. The listing and selling Realtors® for the condo transaction are DMAR members.

The luxury segment continues to grow with 1,671 sold homes thus far in 2019, which is significantly up from 1,231 in 2017 and 773 in 2015. Notably, while the number of sold homes priced $1 million and up has continued to grow, the average price has held strong at around $1.5 million since 2015. However, the single-family segment is showing a slight decline with 194 homes sold in August versus 225 in July, but it is still on track with stats from this time last year.

Average days on market in the luxury segment remain strong at 59 days, up just one day from July’s 58 average days on market and down four days from 62 at this time last year.

“The Luxury Market has been holding strong this year,” states Libby Levinson, DMAR Market Trends Committee member and Metro Denver Realtor®. “While sales in the luxury segment of the market remain steady, home sellers are rejoicing because close-price-to-list price is at 97.4 percent versus 97.01 this time last year.”

According to Levinson, the luxury condo market is “buzzing” with 28 sold properties in August, which is a noticeable jump from 13 this time last year, resulting in 189 total units sold year to date in 2019. This is a big jump from 127 units sold at this time in 2018 and just 58 units in 2015. Due to the number of sales coupled with increasing prices, the sales volume in August almost doubled year over year with over $45.4 million.

Metro Denver Real Estate Market Report - August 2019

AUGUST 2019 - DENVER METRO REAL ESTATE MARKET

While the months of housing inventory still indicate Metro Denver is a seller’s market, it continues to head toward a balanced market with conditions favoring buyers like historically low interest rates, price reductions, more homes to choose from and more time in which to choose.

While the months of housing inventory still indicate Metro Denver is a seller’s market, it continues to head toward a balanced market with conditions favoring buyers like historically low interest rates, price reductions, more homes to choose from and more time in which to choose.

#DMAR Market Trends

Data Source: REColorado

Overall in the Denver-area residential market, 6.19 percent fewer homes were sold in July compared to the month prior and there was a slight uptick in days on market and price reductions.

The average sold price in the residential market in July was $498,960, down slightly from June’s $500,010, yet still up 4.27 percent year over year. The median sold price, however, was up slightly month over month to $434,000 from $429,000. The average single-family home price was up 0.58 percent from June to $551,516, topped only by the slightly higher average prices in April and May. Year to date, the average sold price was up 1.83 percent. The average condo sale price was down 1.46 percent in July to $362,922; this is lower than the past three months, but up 3.01 percent year to date.

“Realtors are having to adjust their pricing methods and we’ve seen a steady stream of price reductions,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “Once a home was priced right, sellers received, on average, just under full asking price with a close-to-list-price ratio of 99.32 percent. I’ve heard from homebuyers that they are not feeling the need to run out and see a property on the first day and, if they wait a couple weeks instead, prices often come down.”

Sellers had their homes on the market for what might have felt like a long time compared to a year ago. The median days on market for single-family homes and condos was up 37.50 percent month over month to 11 days. While that percentage may sound significant, on average, home sellers only had to wait three more days to sell their properties in July compared to last year. Year to date it’s taking, on average, 29 days to sell a home compared to 24 days last year.

Notably, fewer new residential listings came on to the market in July, down 12.37 percent from the month before. With fewer new listings, the pool of active listings, which has been growing for the past six months, finally shrunk a bit as the month ended with 9,359 active residential listings. The month of June’s slightly higher 9,520 active listings was the highest metro Denver has experienced in five-and-a-half years.

According to Schafer, “Despite price reductions, we are still statistically in a seller’s market with 1.73 months of inventory across all price ranges. Properties above $1 million have the most inventory with single-family homes at 4.93 months, just under the five months that make a balanced market. We ended July with 4.36 months of condo inventory. Large condo projects like the Coloradan downtown and The Laurel in Cherry Creek have been closing on units pushing up the number of higher-priced condo sales.”

Schafer adds that additional conditions favoring homebuyers include the Federal Reserve recently dropping the interest rates by 0.25 percent, Denver area experiencing low unemployment, an increased number of active listings compared to the recent past, muted home price appreciation and more time on market for homebuyers to make decisions.

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999). In July 2019, 240 homes sold and closed for $1 million or greater – down 8.40 percent from June and up 8.60 percent year over year. The closed dollar volume in the luxury segment year to date was $2.2 billion, up 6.25 percent from last year.

The highest-priced single-family home that sold in July was $5,779,000 representing five bedrooms, seven bathrooms and 4,733 above ground square feet in Boulder. The highest-priced condo sale was $2,350,000 representing four bedrooms, four bathrooms and 4,850 above ground square feet in Denver. The listing and selling Realtors® for the condo transaction are DMAR members.

Year over year, the number of homes priced $1 million and oversaw an average sales price increase of 5.38 percent, price-per-square-foot increase of 16.61 percent, and sales volume increase of 14.44 percent.

“The increase in the number of luxury homes that sold and sales volume in this high-end home category is partly attributed to more inventory in the Luxury Market due to home value appreciation seen across metro Denver in recent years,” said Bryan Facendini, DMAR Market Trends Committee member and Metro Denver Realtor®. “On the contrary, the number of homes sold, average sales price and sales volume decreased month over month.”

In July, month over month, price per square foot for single-family homes increased 5.41 percent from $296 to $312, and notably decreased 22.56 percent from $625 to $484 for condos. Year to date, at $612 per square foot, condos realized a significant increase of 23.14 percent from $497 per square foot in 2018, while single-family homes realized a 6.01 percent increase.

Overall in the luxury segment, median days on market jumped to 26 days in July compared to 14 days in June. Year-to-date market activity has improved as median days on market for single-family homes has decreased from 24 days in 2018 to 20 days in 2019, and condos have decreased from 26 days in 2018 to 24 days in 2019.

Facendini adds, “While the market is in transition, there are more opportunities for home sellers to cash in on equity gains and homebuyers to take advantage of more leverage in negotiations than in years past, and also lock-in mortgages at extremely low rates. It will be interesting to see how the next few months perform as mortgage applications have increased compared to last year and some economists think we’ll see an increase of homes sold the second half of the year.”

Metro Denver Real Estate Market Report - July 2019

JULY 2019 - DENVER METRO REAL ESTATE MARKET

With metro-Denver housing inventory at its highest level since October 2013 and interest rates still low, now is a good time for homebuyers. On the flip side, with home prices peaking now is also a good time for home sellers; making for a more balanced market.

With metro-Denver housing inventory at its highest level since October 2013 and interest rates still low, now is a good time for homebuyers. On the flip side, with home prices peaking now is also a good time for home sellers; making for a more balanced market.

#DMAR Market Trends

Data Source: REColorado

Housing inventory is up 28 percent year to date from 2018. The first half of this year ended with the most active listings, at 9,520 at the end of June, since October of 2013 which was at 9,734.

For perspective, the record-high June for active listings was in 2006 with 31,900, and the record-low was in 2015 with 6,197 listings.

“I’ve heard this year referred to as the ‘Goldilocks year’ in Denver real estate - not too hot, not too cold,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “We are halfway through 2019 and things feel different than they have in the past few years. In some price points and areas, the market is still very strong for sellers. In others, buyers are gaining the advantage. Why? Continued low interest rates and more housing choices.”

The average sold price in the residential market dipped 0.54 percent from May’s $502,518 to $499,807 at the end of June, but it crept up 1.64 percent year to date.

Furthermore, homes have been staying on the market longer before going under contract this year. The median days on market was up 66.67 percent from six days at this point last year, to 10 so far in 2019. Meanwhile, days on market for all price ranges indicates a seller’s market except homes priced $1 million and up where it’s an equal market between homebuyers and sellers; with 5.16 percent months of inventory for single-family homes.

“I’ve heard listing agents struggling with pricing now that the market is evening out,” adds Schafer. “Homebuyers want to put in low-ball offers only to find out there are other buyers who are willing to come in at asking price, or even higher. The market isn’t what it was, but it’s still strong and looks like it will continue to remain that way. With interest rates staying low and inventory going up, it is really a perfect time to buy. Prices may be high, but are leveling off so it’s still a great time to sell, too. In my opinion this market is just right for everyone.”

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999). In June 2019, 238 homes sold and closed for $1 million or greater – down 15.60 percent from May and 9.85 percent year over year. The closed dollar volume in the luxury segment year to date was $1.8 billion, up 2.62 percent from last year.

The highest priced single-family home that sold in June was $4,775,000 representing five bedrooms, seven bathrooms and 6,406 above ground square feet in Denver. The highest priced condo sale was $6.74 million representing three bedrooms, four bathrooms and 4,761 above ground square feet in Denver. The listing and selling REALTORS® for both transactions are DMAR members.

According to Schafer, more choices for homebuyers means sellers have had to make price adjustments to be competitive. Sellers with homes priced between $1,500,000 and $1,750,000 have been taking the biggest cut with a 91.20 percent sale-to-original-price ratio for single-family homes and 94.9 percent for condos. The overall residential market’s close-price-to-list-price ratio year to date was 99.41 percent; so, sellers were getting, on average, more than the asking price at this point in the past four years.

Year to date in the Luxury Market overall, single-family home sales were down 2.72 percent year over year, but up 34.05 percent compared to 2017 with 242 more single-family homes sold this year compared to 2017. The luxury condo market also saw striking results with sales up year to date at 38.78 percent year over year and 4.26 percent since 2017, with 42 more luxury condos sold since 2017.

“Making a splash and sliding downward are the days on market in the single-family luxury segment,” said Brigette Modglin, DMAR Market Trends Committee member and Metro Denver REALTOR®. The average days on market year to date was 58, down 13.43 percent year over year and 22.99 percent since 2017. Also sliding downward were the luxury condo average days on market, down 19.70 percent from one year ago from 66 to 53 days on market, and down 14.29 percent from 2017.

“While things seem to be pointing in the right direction with more inventory in the luxury segment of the market, sales of single-family luxury homes were slightly down from 1,067 sales year to date in 2018 compared to 1,038 year to date in 2019, a 2.72 percent decrease,” adds Modglin. “Diving into the numbers, they still look good as we are in a more balanced market and all signs show this is good for both buyers and sellers in the Denver Metro Luxury Market.”

Notably, things are changing in the Signature Market too, particularly in the condo segment. The year-to-date average days on market for a condo in this price range is 58, and the median is 24. Compared to this time last year that is an increase of 31.82 percent and 84.62 percent, respectively. “Given this information, it won’t be a surprise to hear that there are 5.59 months of inventory for condos in this segment, more than any other price segment we monitor,” adds Taylor Wilson, DMAR Market Trends Committee member and Metro Denver REALTOR®.

Metro Denver Real Estate Market Report - June 2019

June 2019 - DENVER METRO REAL ESTATE MARKET

Month of May recorded highest housing inventory in Metro Denver since 2013 and record-breaking average single-family home price. In May, there were 8,789 new listings, up 16.97 and 38.12 percent from the previous month and year, respectively.

Month of May recorded highest housing inventory in Metro Denver since 2013 and record-breaking average single-family home price.

#DMAR Market Trends

Data Source: REColorado

In May, there were 8,789 new listings, up 16.97 and 38.12 percent from the previous month and year, respectively. At month’s end, 6,470 homes went under contract, up 5.65 and 10.5 percent from April and last year, respectively. Notably, the average single-family home price reached a record-breaking $555,482.

“Even with all of those offers written and accepted, we still ended the month with 8,891 homes for sale,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “That’s an important number to note. It’s the highest end-of-month number of active listings since November 2013 when buyers had 9,352 choices.”

For further perspective, inventory in the Denver-area real estate market was at 26,333 active listings in May 2008.

Schafer adds, “The market has been experiencing a drought of new homes for years, so the increase in inventory is a welcome relief for thirsty buyers. Sellers have been experiencing an unprecedented increase in values. Even with the added inventory, prices were still up a bit.”

The average sold price for a single-family home in the 11-county metro area year to date was $534,577 in May, up 1.45 percent from last year. The median home price hit a record-breaking $450,000 for the first time, up 1.12 percent from this point in 2018. The average sold price for condos year to date bumped up 3.11 percent compared to last year to $364,134, and the year-to-date median price topped out at a high of $301,500.

“To get those higher prices, home sellers had their homes on the market a little longer before accepting an offer,” shares Schafer. Year to date, homes were taking an average 32 days to sell compared to 26 days last year. The median days on market jumped from six at this point in each of the past four years, to 11 so far this year.

“There has also been more negotiating,” comments Schafer. “The close-to-list price ratio dropped to 99.35 percent year to date. At this point in the past four years, sellers were getting, on average, more than asking price. Home sellers still have control across the housing price ranges, but a little give and take makes buyers feel better.”

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999). In May 2019, 262 homes sold and closed for $1 million or greater – up 5.22 percent from April and 3.15 percent year over year. The closed dollar volume in the luxury segment year to date was $1.44 billion, up 5 percent from last year.

The highest priced single-family home that sold in May was $4.25 million representing seven bedrooms, nine bathrooms and 5,782 above ground square feet in Englewood. The highest priced condo sale was $3.35 million representing three bedrooms, four bathrooms and 3,228 above ground square feet in Denver. The listing and selling REALTORS® for both transactions are DMAR members.

From a year-to-date perspective, the number of homes sold in the Luxury Market remained relatively level at 915, up 1.55 percent from last year. While sales in the single-family market decreased year to date by 2.78 percent from 2018, there has been a large jump in condo sales with 110 sold year to date compared to 73 in 2018, an increase of 50.68 percent.

There has not been any significant changes month over month or year over year in terms of price per square foot, outside of the condo total price per square foot metric that significantly jumped from $546 last year to $656 in May of 2019 - an increase of 20.15 percent. Single-family average price per square foot continues to hover around $300, ending May at $297.

Overall, the average days on market in the luxury segment improved by 11 days for a total of 47 days on market. “Home sellers still have a slight upper hand considering the months of inventory, but buyers will have opportunity as well,” said Bryan Facendini, DMAR Market Trends Committee member and Metro Denver REALTOR®.

“Each neighborhood is performing differently; therefore, understanding how each submarket is performing will be important to consumers because some luxury homes could sell quickly, while other submarket luxury homes are under performing; meaning homes are staying on the market longer and garnering lower prices,” comments Facendini.

Metro Denver Real Estate Market Report - May 2019

May 2019 - DENVER METRO REAL ESTATE MARKET

Amidst more housing inventory and increased days on the market, Denver-area homes priced right are selling for top dollar. In April, the average single-family sold home price in metro Denver hit a record high of $553,371, and reached a year-to-date high of $527,244.

Amidst more housing inventory and increased days on the market, Denver-area homes priced right are selling for top dollar.

#DMAR Market Trends

Data Source: REColorado

In April, the average single-family sold home price in metro Denver hit a record high of $553,371, and reached a year-to-date high of $527,244. The average condo sold price in April was $368,565, up 2.62 percent from March and up 2.17 percent year to date.

“Spring is a great time to take in the smell of the blooming bushes and put things into perspective because this month is all about perspective,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “Some housing market stats look like the sky is falling, but when put into perspective you can see why prices continue to go up in the Denver Metro area.”

It took twice as long to sell a house so far this year compared to this point in 2018. Schafer comments, “That sounds alarming, doesn’t it? The 100 percent increase is accurate, but when you realize that means the median went from six days on the market in 2018 to 12 days in 2019, it doesn’t look so bad. Less than two weeks on the market is still fast.”

Another example of the need for perspective is that April ended with 7,012 active listings. In the past four years, active listings at the end of April were in the low 5,000’s, so April is up 35.89 percent year to date compared to last year. That is significant, yet it is a seller’s market in every single price range according to Schafer. She adds, “Overall there is only 1.5 months of single-family housing inventory and 1.49 months of condo inventory. That is much lower than the 5-6 months of inventory needed to equalize the market between buyers and sellers.” Metro Denver had 7,518 new listings hit the market in April, up 21.28 percent from March, and homebuyers actively purchased the new choices with 18.76 percent more homes under contract month over month.

“More choices, more contracts, a tiny bit of negotiating room and prices still going up. No matter what your perspective is, that sounds like a good market to me,” Schafer states.

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $400,000 and $499,999). In April 2019, 243 homes sold and closed for $1 million or greater – up 32.2 percent from March and 4 percent year over year. The closed dollar volume in the luxury segment year to date is already over $1 billion, up 1.61 percent from last year and up 41.47 percent from 2017.

The highest priced single-family home that sold in April was $8.5 million representing four bedrooms, eight bathrooms and 13,034 above ground square feet in Denver. The highest priced condo sale was $5,434,891 representing three bedrooms, four bathrooms and 3,816 above ground square feet in Denver. The listing and selling Realtors® for both transactions are DMAR members.

“This is no April Fool’s joke - the Luxury Market loved April,” said Andrew Abrams, DMAR Market Trends Committee member and metro Denver Realtor®. “This segment saw increased pricing, number of homes sold and overall sales volume compared to the previous month and year.”

Abrams adds, “While many feel that the million-dollar-plus market is becoming saturated and moving towards a seller’s market, based off of the stats, I would say that it is moving very slowly. For single-family homes, the months of inventory is 4.41, and for condos it is 3.24. Many Realtors® would still consider this a buyer’s market.” Both the average and median days on market decreased from the previous month and year. The median days on market was 14 days in April, down from 21 days in March and 19 days in April of 2018.

As the Greater Denver Metro area has grown, so has its homebuyer pool. The quantity of Luxury Market homes sold year to date in 2019 was similar to the previous year, 638 and 647 respectively. This is a drastic increase from 2015 to 2017 where the range was from 230 sold properties to 461, respectively. According to Abrams, this can be attributed to the strong economy and stability within the local Denver-area community.

Metro Denver Real Estate Market Report - April 2019

APRIL 2019 - DENVER METRO REAL ESTATE MARKET

Metro Denver is still a seller’s market, but increased housing inventory means improved conditions for homebuyers. In March, the number of new residential listings (single-family and condos) was up 21.75 percent from February, and buyers liked what they saw, with the number of homes going under contract increasing 27.39 percent from the month prior, an increase of 4.27 percent year over year.

Metro Denver is still a seller’s market, but increased housing inventory means improved conditions for homebuyers.

DMAR Market Trends

Data Source: REColorado

In March, the number of new residential listings (single-family and condos) was up 21.75 percent from February, and buyers liked what they saw, with the number of homes going under contract increasing 27.39 percent from the month prior, an increase of 4.27 percent year over year.

“When more homes go under contract than come on the market, it begins to chip away at the surplus inventory that built up in the last half of 2018,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “While buyers are starting to push back on sellers’ list prices, they still have to put their best foot forward because, comparatively speaking, there’s not a lot of inventory to choose from.”

According to Schafer, while it’s not likely that Denver real estate will be in for another record-breaking spring and summer, things won’t be slowing down much either, as the number of agents still searching for something to meet their buyer’s needs is reflected in the low months of inventory. The market under $1 million is still very much a seller’s market, and the market over $1 million is almost equal between buyers and sellers, with 5.16 months of single-family inventory, and 5.59 months of attached-home inventory. “At this point, buyers still do not have the upper hand in any price range,” adds Schafer.

DMAR’s monthly report also includes statistics and analyses in its supplemental Luxury Market Report (properties sold for $1 million or greater), Signature Market Report (properties sold between $750,000 and $999,999), Premier Market Report (properties sold between $500,000 and $749,999) and Classic Market (properties sold between $300,000 and $499,999). In March 2019, 169 homes sold and closed for $1 million or greater – which is up 30 percent from February, but down 9.14 percent year over year. The closed dollar volume in the luxury segment was $262,491,476, up 31.79 percent from February, but down 7.12 percent year over year.

“March is certainly out like a lion, and the Luxury Market is primed for a strong spring season,” said Libby Levinson, DMAR Market Trends Committee member and metro Denver REALTOR®. “The average days on market for detached single-family homes dropped to 50 in March, from to 82 last month and 75 this time last year. With this type of activity, it’s no surprise that the close to list price ratio is still holding strong at 97.72 percent.”

The highest priced single-family home that sold in March was $4.5 million representing six bedrooms, seven bathrooms and 5,968 above ground square feet in Boulder. The highest priced condo sale was $4.1 million representing three bedrooms, four bathrooms and 4,723 above ground square feet in downtown Denver.

The DMAR Market Trends Committee releases reports monthly, highlighting important trends and market activity emerging across the Denver metropolitan area. Reports include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson and Park counties. Data for the report was sourced from REcolorado® (April 2, 2019) and interpreted by DMAR.

Metro Denver Real Estate Market Report - March 2019

MARCH 2019 - DENVER METRO REAL ESTATE MARKET

Denver buyers feel the love with increasing inventory and lower interest rates. In February, for the entire residential market (single family and condos), there was a 47.33 percent increase in active listings year over year generating a 5.6 percent increase in new listings compared to the month prior.

Denver buyers feel the love with increasing inventory and lower interest rates.

#DMAR Market Trends

Data Source: REColorado

In February, for the entire residential market (single family and condos), there was a 47.33 percent increase in active listings year over year generating a 5.6 percent increase in new listings compared to the month prior.

“Love was in the air in February’s real estate market. Buyers were loving homes so much they put 15.64 percent more homes under contract in the 11-county Denver metro area than they did in January,” said Jill Schafer, Chairwoman of the DMAR Market Trends Committee and metro Denver REALTOR®. “We’re definitely seeing the seasonal market pick up with the average number of homes sold in February up 4.77 percent month-over-month.”

Schafer assesses that the increase in contracts can be partly attributed to the increase in choices. “Buyers took advantage of the additional 5.60 percent of new listings, which was 47.33 percent more active listings to choose from than they had at this point a year ago,” added Schafer.

According to Schafer, more single-family homes went under contract in February than came on the market, meaning the inventory surplus is eroding, which is not the case with attached homes.

“The number of active condo listings has risen steadily over the past four years,” Schafer noted. “A 79.14 percent jump in active listings at the end of the month increases the spread between inventory and demand, which is a notable increase.”

Schafer concludes that overall, the Denver metro area is still in a strong seller’s market with only 1.92 months of single-family inventory available. “Only detached homes priced over $1 million were in a buyer’s market with 6.58 months of inventory,” Schaffer notes. “At the current rate of sales, there’s 2.07 months of attached home inventory overall. But, buyers are in the power position with 6.24 months of inventory for condos priced between $750,000 and $999,999, and 7.31 months of inventory over $1 million.”

According to industry standards, under five months of inventory is a seller’s market and over six months of inventory is considered a buyer’s market.

Out monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999) and “Premier Market Report” (properties sold between $500,000 and $749,999). In February, 119 homes sold and closed for $1 million or greater – up 22.68 percent from the previous month and down 6.3 percent year over year. The closed dollar volume in February in the luxury segment was $ 178,766,560 up 13.99 percent from the previous month, and down 4.94 percent year over year.

The highest priced single family home sold in July was $8,200,000 representing seven bedrooms, 12 bathrooms and 12,878 above ground square feet in Cherry Hills Village. The highest priced condo sold was $3,950,000 representing four bedrooms, five bathrooms and 4,753 above ground square feet in Denver. All the listing and selling agents for the two transactions are DMAR members.

“Love was also abundant in the Luxury Market in February as single-family and condo sales were up 22.68 percent,” stated Brigette Modglin, DMAR Market Trends Committee member and metro Denver REALTOR®. “Signature Market buyers should consider jumping into the Luxury Market, since there is 6.58 months of inventory.”

Notably, Modglin adds that even with the current increase of inventory in the Luxury Market, it’s still nowhere near where it was in 2010 when there was 27.2 months of inventory.

Metro Denver Real Estate Market Report - February 2019

FEBRUARY 2019 - DENVER METRO REAL ESTATE MARKET

Home sellers in Metro Denver continue to see year-over-year home price appreciation and more homes under contract, yet buyers have more choices as housing inventory has increased. In January, the number of new residential listings (single-family and condos) leaped 109.7 percent from December to 4,821, an increase of 13.6 percent year over year.

Home sellers in Metro Denver continue to see year-over-year home price appreciation and more homes under contract, yet buyers have more choices as housing inventory has increased.

In January, the number of new residential listings (single-family and condos) leaped 109.7 percent from December to 4,821, an increase of 13.6 percent year over year. Active listings were up just 5.45 percent from the month prior, and up 52 percent compared to 2018’s record-low January reaching 5,881. Notably, the number of active listings is still significantly below the historic average in the month of January of 13,469 (1985-2018).

“Choices, choices, choices! Buyers should be doing a happy dance because they finally have some choices,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “Even though the Denver metro area is still a seller’s market in most price ranges, there’s no doubt this is the best time to buy in a long time!”

According to Schafer, it’s often said that the Denver real estate market doesn't shift into full gear until after the Super Bowl, but with more choices, interest rates lower than expected and warmer weather than usual, homebuyers were putting in more contracts in January, up 33.97 percent from December and 7.24 percent year over year. As such, higher home sales are expected next month.

While buyers are taking advantage of their housing choices, home sellers are still seeing appreciation with the average sold price of a home up 2.89 percent year over year, an increase from $448,132 in January 2018 to $461,101 in January 2019. “Apparently, both homebuyers and sellers can dance as having choices seems to be a good thing for all,” adds Schafer.

DMAR’s monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $400,000 and $499,999). In January 2019, 93 homes sold and closed for $1 million or greater – down 31.11 percent from December and 14.68 percent year over year. The closed dollar volume in the luxury segment was $150,646,236, down 24.26 percent from December and 9.37 percent year over year.

“There are 7.65 months of inventory in the $1 million plus price point, so the pendulum has fully swung and the Luxury Market has officially changed to a buyer’s market,” said Andrew Abrams, DMAR Market Trends Committee member and metro Denver REALTOR®. “However, that hasn’t necessarily changed how quickly luxury buyers need to pull the trigger.”

According to Abrams, the most astonishing stat of the month is the median days on market. From 2016 to 2018, the median days on market has ranged from 71 to 84. In January, the median days on market for a home was at 41, which is less than half the days from the previous year.

The highest priced single-family home that sold in January was $5.1 million representing four bedrooms, six bathrooms and 10,188 above ground square feet in Boulder. The highest priced condo sale was $10,750,000 million representing three bedrooms, five bathrooms and 6,295 above ground square feet in Denver.

Metro Denver Real Estate Market Report - January 2019

January 2019 - Metro Denver Real Estate Market Report

Despite what feels like a major market shift, home sellers in Metro Denver are still in control in all housing price ranges, except homes priced over $1 million where homebuyers and sellers are on equal footing. In 2018, compared to 2017, the number of home sales was down 5.52 percent and housing inventory was up 44.71 percent by year-end.

Despite what feels like a major market shift, home sellers in Metro Denver are still in control in all housing price ranges, except homes priced over $1 million where homebuyers and sellers are on equal footing.

#DMAR Market Trends

Data Source: REColorado

In 2018, compared to 2017, the number of home sales was down 5.52 percent and housing inventory was up 44.71 percent by year-end. 2018 marked a record-high home sales price reaching an average of $473,539 and median of $409,900 for the entire residential market (single-family and condos), up 8.34 percent and 7.87 percent year over year respectively.

“Sellers celebrated in the first half of the year with a crazy blur of multiple offers and fast sales,” said Jill Schafer, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “It was buyers’ turn to celebrate when the housing inventory jumped up in May and June, causing a market adjustment in the second half of the year and finally giving them some choices.”

With more competition, many home sellers had to make price reductions for the first time in years according to Schafer. She shares, “With sales down and inventory up, it might not make a lot of sense for home prices to be up, but they continued to rise.”

The average price for a single-family home in 2018 was $522,839, up 8.05 percent in a year. The average price of a condo increased 9.82 percent, ending 2018 at $351,677. Home prices continue to rise in large part because people continue to move to the Denver area. According to the US Census Bureau, 80,000 people moved to Colorado from mid-2017 to mid-2018. Schafer adds that Millennials are pouring into the real estate scene as first-time homebuyers adding to the demand.

Notably, sales volume in the entire residential market hit a high too in 2018 at $26.5 billion, up 2.36 percent compared to the year prior.

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $400,000 and $499,999). In 2018, 2,156 homes sold and closed for $1 million or greater – up 18.14 percent compared to 2017. The closed dollar volume in 2018 in the luxury segment was a record-breaking $3.29 billion, up 18.10 percent compared to 2017.

Activity with single-family homes priced over $1 million was up 39.4 percent over the year prior, with 3,892 active listings in 2018. Condo listings in 2018 were up 58.66 percent year over year with 1,685 active listings at year-end. Notably, in the entire luxury residential market, the average price of a home that sold dipped slightly to $1,525,441, down 0.03 percent, and the median priced remained unchanged since 2014 at $1,300,000.

The highest priced single-family home that sold in December was $6,800,000 representing seven bedrooms, 12 bathrooms and 9,826 above ground square feet in Cherry Hills Village. The listing and selling agents for this transaction are DMAR members. The highest priced condo sale was $1.68 million representing three bedrooms, four bathrooms and 3,117 above ground square feet in Denver.

“While sales overall have slowed slightly, homes are selling faster in the Luxury Market and the closed-price to list-price differential is negligible,” stated Libby Levinson, DMAR Market Trends Committee member and metro Denver REALTOR®.

In the single-family Luxury Market, 112 homes sold during the month of December, down slightly from 115 in November and 118 year over year. According to Levinson, “The good news is that the average days on market for luxury homes dipped slightly to 72 in December from 74 days in November and 110 year over year. Close-price to list-price was also up, just shy of two percent from December of 2017.”

Meanwhile, the luxury condo market held strong with 16 units sales in December, which is on target with the 16 units that sold in November and in December of 2017. Notably, the days on market in the condo sector dropped over 55 percent to 54 days in December from 121 days in both the month prior and December of 2017. Alternatively, from the single-family market, the condo segment saw a dip of just over one percent of the close-price to list-price ratio.

November 2018 Market Report

NOVEMBER 2018 MARKET REPORTS

Sales and new listings typically decline in November as the weather cools and focus turns toward the holiday season. This year was no exception. The Denver Metro Area housing market saw a decline in home sales during November, while average sold prices have leveled off month over month.

Sales and new listings typically decline in November as the weather cools and focus turns toward the holiday season. This year was no exception. The Denver Metro Area housing market saw a decline in home sales during November, while average sold prices have leveled off month over month.

Watch Video

Denver Metro Infographic

Download Detailed Reports

October 2018 Market Report

OCTOBER 2018 MARKET REPORTS

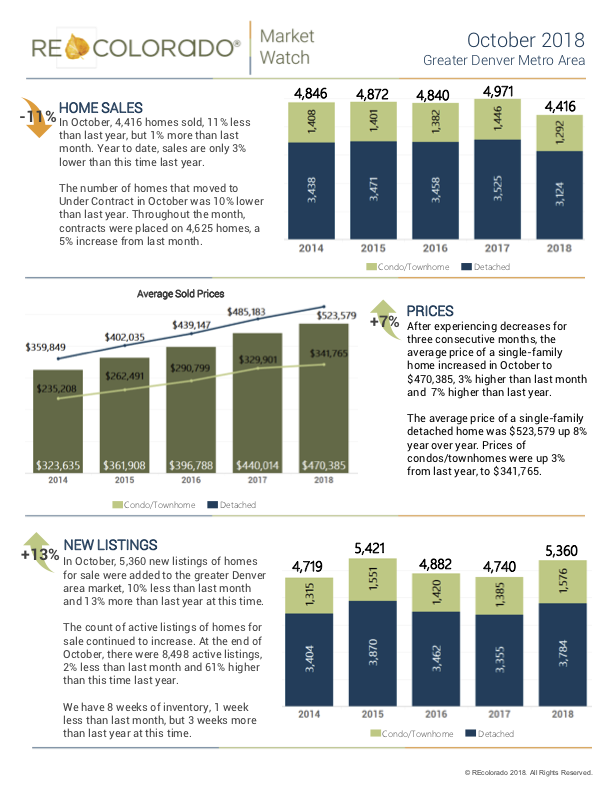

As we head into November, home shoppers and the Denver Metro Area housing market prepare for the holiday season. Home sales leveled off in October, remaining fairly consistent compared to last month. Year to date, home sales are only 3% lower than this time last year. Meanwhile, 13% more new listings came on the market across Denver.

As we head into November, home shoppers and the Denver Metro Area housing market prepare for the holiday season. Home sales leveled off in October, remaining fairly consistent compared to last month. Year to date, home sales are only 3% lower than this time last year. Meanwhile, 13% more new listings came on the market across Denver.

Watch Video

Denver Metro Infographic

Download Detailed Reports

September 2018 Market Report

SEPTEMBER 2018 MARKET REPORTS

As the weather cools, we often see a seasonal slowing in the Colorado housing market. Fewer homeowners are interested in moving into a new home during this time of year. This time is often spent preparing for winter, knowing the holiday season will soon be upon us. The latest housing market data from REcolorado show this trend held true in the Denver this September.

In September, 4,229 homes sold across the Denver Metro area, 25% lower than last month. There was also a decrease in the number of homes under contract, 5% fewer than last month. However, year-to-date sales are only 3% lower than this time last year.

As the weather cools, we often see a seasonal slowing in the Colorado housing market. Fewer homeowners are interested in moving into a new home during this time of year. This time is often spent preparing for winter, knowing the holiday season will soon be upon us. The latest housing market data from REcolorado show this trend held true in the Denver this September.

In September, 4,229 homes sold across the Denver Metro area, 25% lower than last month. There was also a decrease in the number of homes under contract, 5% fewer than last month. However, year-to-date sales are only 3% lower than this time last year.

Watch Video

Denver Metro Infographic

Download Detailed Reports

August 2018 Market Report

AUGUST 2018 MARKET REPORTS

Greater Denver Metro home sales continued to slow slightly, which is typical for this time of year, especially after a strong summer selling season. Year to date, homes sales are down just one percent as compared to last year. Most notably, sellers continued to add new listings of homes for sale to the market—4 percent more than last month. That, combined with homes staying on the market about four days longer than last month, could give buyers more options and more time to browse.

Greater Denver Metro home sales continued to slow slightly, which is typical for this time of year, especially after a strong summer selling season. Year to date, homes sales are down just one percent as compared to last year. Most notably, sellers continued to add new listings of homes for sale to the market—4 percent more than last month. That, combined with homes staying on the market about four days longer than last month, could give buyers more options and more time to browse.

Watch Video

Denver Metro Infographic

Download Detailed Reports

July 2018 Market Report

JULY 2018 MARKET REPORTS

July 2018 market statistics brought signs that the Greater Denver Metro market is experiencing typical seasonal slowing, following an active selling season. Notably, the average price of a home saw a month-over-month decrease for the first time this year. Watch the video above and look down below for infographics and reports.

July 2018 market statistics brought signs that the Greater Denver Metro market is experiencing typical seasonal slowing, following an active selling season. Notably, the average price of a home saw a month-over-month decrease for the first time this year. Watch the video above and look down below for infographics and reports.

Watch Video

Denver Metro Infographic

Download Detailed Reports

June 2018 Market Report

JUNE 2018 MARKET REPORTS

The housing market in the Greater Denver Metro Area may be shifting. The latest data from REcolorado show both home sales and new listings were down compared to this time last year. Meanwhile, average sold prices for single family homes continues to rise.

The housing market in the Greater Denver Metro Area may be shifting. The latest data from REcolorado show both home sales and new listings were down compared to this time last year. Meanwhile, average sold prices for single family homes continues to rise.

Watch Video

Denver Metro Infographic

Download Detailed Reports

May 2018 Market Report

MAY 2018 MARKET REPORTS

As peak home buying and selling season comes to Denver, the housing market continues its fast pace, according to May 2018 market statistics numbers from REcolorado. Most notably, there was an increase in the number of new listings in the Greater Denver Metro Area.

As peak home buying and selling season comes to Denver, the housing market continues its fast pace, according to May 2018 market statistics numbers from REcolorado. Most notably, there was an increase in the number of new listings in the Greater Denver Metro Area. Additionally, the average price of a single-family detached home saw a slight decrease for the first time this year. Watch this video and look down below for infographics and reports.

Watch Video

Denver Metro Infographic

Download Detailed Reports

April 2018 Market Report

APRIL 2018 MARKET REPORTS

The latest housing market data from REcolorado show more sellers listing their home for sale as the weather warms in the Greater Denver Metro Area. Home sales remain consistent with this time last year, falling only 1%, while average sold price continues to rise in Colorado.

The latest housing market data from REcolorado show more sellers listing their home for sale as the weather warms in the Greater Denver Metro Area. Home sales remain consistent with this time last year, falling only 1%, while average sold price continues to rise in Colorado.

Watch Video

Denver Metro Infographic

Download Detailed Reports

MARCH 2018 MARKET REPORT

MARCH 2018 MARKET REPORTS

The latest data from REColorado show that demand from home buyers remains strong in the Greater Metro Denver Area. Housing market statistics increased month-over-month, indicating the start of the home buying and selling season in Colorado.

The latest data from REcolorado show that demand from home buyers remains strong in the Greater Metro Denver Area. Housing market statistics increased month-over-month, indicating the start of the home buying and selling season in Colorado.